We all want our kids to grow up having a healthy relationship with money. Financials are such a huge part of our lives and can either set you for success or stress. So what age is the best age to start teaching kids about money? The answer is right now. Whether their age zero to eighteen, there are many ways to introduce financial education or get started saving. Be sure to check this page often for product spotlights as well as new financial tips!

March Coloring Contest!

We have two, fun St. Patrick's Day coloring sheets for you to get creative with! Parents: Print off a coloring sheet for your child(ren) and when it is completed, turn it into your nearest Citizens Bank Minnesota location by March 28, 2025. There will be one winner from the 0-5 age group, and one winner from the 6-12 age group. Winners will receive a $10 gift card to McDonald's and will be notified on March 31, 2025.

St. Patrick's Day Coloring Sheet 1

St. Patrick's Day Coloring Sheet 2

*Do not need to open an account or be a client of Citizens Bank Minnesota to win. No deposit required. Contest starts 3-18-25 and runs through 3-28-25. Two random recipients will be announced on 3-31-25.

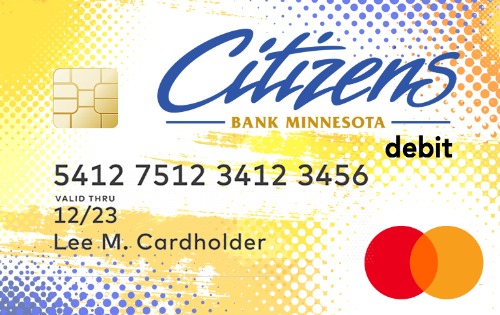

Product Spotlight: Youth Debit Cards

Looking for solutions for your kids when they travel to cashless venues or need access to money? We have an answer for you: Youth Debit Cards! Through online banking you can set controls, rules and spending limits on cards. Put your mind at ease when sending your child to hang out with friends, attend events, school field trips or even to have in case of an emergency.

Looking for solutions for your kids when they travel to cashless venues or need access to money? We have an answer for you: Youth Debit Cards! Through online banking you can set controls, rules and spending limits on cards. Put your mind at ease when sending your child to hang out with friends, attend events, school field trips or even to have in case of an emergency.

Option #1: Add a partner card to your account. Is your child too young for a checking account of their own but still in need of a taking a card with them when traveling? Add an extra card to your existing account. We even have a fun design to help keep that card separate from your own. Through your online banking, you can set spending and ATM limits, apply rules, temporarily turn off the card, reset PIN numbers, and monitor debit card usage.

Option #2: Open a debit card attached to your child’s account. Using a debit card and tracking purchases is a great way to build good financial habits. Even though the account is attached to your child’s account, being a joint owner (which all children under 18 must have on their account) allows you to have the account in your online banking to help your child manage their account and card controls.

Contact us if you are interested in getting a youth debit card!

Little Savers (ages 0-7)

Ways to Save:

Ways to Save:

This may be the easiest age to have your child save money. The first few years, your child is not old enough to have long wish lists of toys and “stuff”. It is an excellent idea to take the birthday, Christmas, special occasion money they receive their first few years and put it directly into a bank account or CD. They can start earning compound interest at a young age which will literally “pay off” in the long run. Once they reach school age and start to have wants, it’s a great time to get them a piggy bank and introduce the concept of short-term saving and long term saving. Any money they receive or earn can be split between their bank account for long-term saving and their piggy bank for short term savings for something special. To fund their savings accounts and piggy banks it's also a great time to introduce earning money through age-appropriate chores.

Product Options:

What is the best type of account to open for a young child? While every situation is a little different, we have a couple different accounts that can help your child save.

WooHoo! U: Our in-house youth savings account is a great way to start! Featuring “great rates till you graduate” our youth accounts boast a higher interest rate until age 18.

Click the button below for more details on WooHoo! U, a regular savings account and CD's at Citizens Bank Minnesota.

Books to check out:

Rock, Brock and the Savings Shock

The Berenstain Bears – Dollars and Sense

Tweens (ages 8-13)

Savings Goals:

Savings Goals:

This is the age to get youth excited and on board for learning about money and financial goals. Habits taught at this age will hopefully stick with them through adulthood. To learn about savings, you will want to dive into the following topics:

- Piggy Bank

- Wallet

- Bank Account

- Safe

- Responsible Adult

- Purse

- Short Term Savings – What is something special I am saving up for that I want/need in the near future? Examples: new game, book, toy, outfit

- Long Term Savings – What is something important that I will want/need in the future that might take me a while to save for? Examples: Phone, computer, car, sports equipment

- Saving for the Future – What are important needs as an adult that I want to start saving for? Examples: College, house, vehicle.

- Charitable Giving – Is is important to you to to help others with your money?

Use this worksheet to start working on your savings goals.

Here's a fun Income vs. Expenses activity!

Earning and Budgeting: Now that you have your savings goals, how do you want to earn money?

- Brainstorm ways that you can earn money to achieve your goals.

- Write down all the ways you are currently receiving money.

- Make a list of things you could do to earn money.

- Talk over your list with your parents or trusted adult and formulate a plan.

- After you earn your money, make a plan on which buckets you will contribute to.

Use this fun sheet to get started.

Books to check out:

Alexander, Who Used to be Rich Last Sunday

Teens (ages 14-18)

When is the right time to open a checking account?

When is the right time to open a checking account?

While there is no one specific right age that a young person should open a checking account, here is a list you can go through that might help you decide.

- Do you have a job that you are receiving a paycheck for?

- Do you have any bills or expenses that you are responsible for paying?

- Do you need access to your money on a regular basis throughout the week?

- Are you ready to take on the financial responsibility of having your own account?

If you answer yes to any of these questions, then its probably time for you to talk to your parent or guardian about opening up a checking account. Young adults have varying levels of responsibility and maturity so its important to discuss this with a trusted adult and someone that knows you well and can help guide you.

What you need to open an account:

- If you are under the age of 18, you will NEED to have a parent or guardian with you to open the account and be a joint owner. (If parent or guardian is not a current client of the bank, we will need their social security number, drivers license, phone number, email, and name of employer and occupation)

- Child will need to know their social security number, phone number, and email. If you have a student ID card or drivers license/instructional permit, please bring that with. The Client Service Representative will also note your job and employer, if applicable.

- The process from start to finish can take around an hour.

- Call and make an appointment with a Client Service Representative

Visit our Checking Account page

Real World Readiness:

Once you start high school, you are getting closer and closer to being an independent adult. A helpful activity to do with your parents is make a list of skills and budget items to master before moving out. Find out what expenses you will be expected to pay so you can include that in your budget. It’s also a great time to ask about how payments are made, how often they are due, and if any paperwork is needed. For a full check-list of life skills to know before graduating, click HERE.

Books to check out: