Debit Cards

Reader Friendly MasterCard Guide to Benefit

Report A Lost Or Stolen Card

If your Citizens Mastercard® Debit Card has been lost or stolen please contact Citizens Bank Minnesota immediately at (507) 354-3165.

You also have the ability to report a lost or stolen card from within our Go! Mobile app and iTalk service.

After business hours, lost and stolen cards can be reported by calling Card Member Services at 888-297-3416.

Traveling

Here at Citizens Bank Minnesota safety and security of our clients' accounts is priority. As a precaution International Debit Card transactions are blocked based on monitored fraud patterns. If you are traveling International, please notify Citizens at 1-800-549-0194 or (507) 354-3165 with dates and the location of your travel and your card will be open for use.

Limits

As an account protection, Debit Cards have daily purchase and withdrawal limits. Should you need these adjusted for a large purchase or for a period of time, please contact Citizens Connection at 1-800-549-0194 or (507) 354-3165.

Fraud Monitoring

In the event there are unusual attempts or transactions on your Debit Card, you may receive a call from an after hours fraud service or a bank representative. Your card may be placed on hold for your protection until the transaction history is verified by you.

**Important: Fraud service representatives only need to verify transaction information. Scam calls often try to obtain account specific information, which when given, compromises your accounts. Should you provide any of the following: Debit Card Number, Expiration Date, Routing and Account number to an unauthorized party, they will have the ability to fraudulently access your funds. Be cautious. If you receive a suspicious call provide NO information, but instead disconnect the call. Contact Citizens Connection at 1-800-549-0194 or (507) 354-3165 with any questions or concerns.

MoneyPass® ATMs

Use your Citizens MoneyPass ATM card at any of the ATMs listed on their website without paying a surcharge. Simply visit their website. If an address has more than one ATM, please look for the MoneyPass logo on a sign at the ATM or displayed on the ATM screen to avoid paying a surcharge.

.png)

Use Your Debit Card to Make Cash & Check Deposits

Did you know our New Ulm and Lakeville ATMs take cash and check deposits? It is super easy, just follow the on-screen prompts or watch this video to get familiar with the process. Just another innovative way to bank with Citizens!

Credit Cards

Mobile Wallet

A mobile wallet is a way to carry your debit card or credit card information in a digital form on your mobile device. Instead of using your physical card to make a purchase, you can pay with your smartphone, tablet or smartwatch. Load your Citizens Bank Minnesota Mastercard® Debit Card into your Mobile Wallet, make it your default card and simply Tap - Pay - Done!You can use your Citizens Mastercard® Debit Card with any of these trusted wallets: Apple Pay, Google Pay, Samsung Pay and Masterpass.

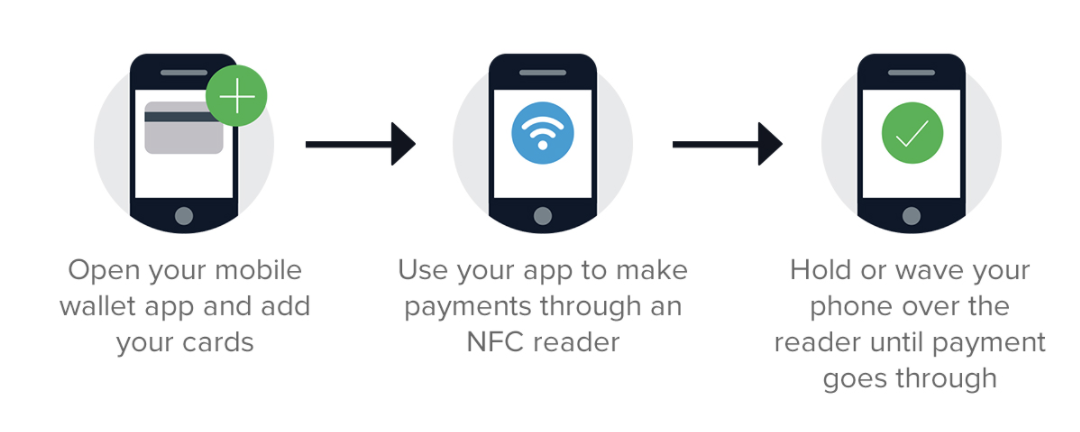

How Mobile Wallets Work

- Download the mobile wallet app (or it may already be built into your mobile device).

- Add your credit card or debit card information to the mobile wallet.

- When you check out at participating merchants, access the mobile wallet and choose your card. If you're making an in-store purchase, just hold your mobile device at the terminal, over the Near Field Communication (NFC) reader.

- It's a safer way to pay! Digital wallets generate a one-time-use number each time you shop to help keep your information private. Your payment information is never shared with merchants or stored on your device. Plus when you use your Citizens Mastercard® Debit Card, you're also covered with Mastercard® Zero Liability - so you're not liable for unauthorized purchases.

- It's easy and convenient! Stop fumbling with your wallet, pay with a simple tap, click or touch.

- It reduces your risk of losing your physical card as well as less wear and tear on it!

- You can use it online if the merchant accepts it!

Just hold your Android mobile device near the reader with your finger on Touch ID.

Just hold your Android mobile device near the reader with your finger on Touch ID. Apple Pay

Just hold your iPhone near the reader with your finger on Touch ID or double-click the side button on your Apple Watch, then hold it near the reader. When shopping on a MacBook Pro featuring the Touch Bar, you can complete your purchase by simply placing your finger on Touch ID.

Just hold your iPhone near the reader with your finger on Touch ID or double-click the side button on your Apple Watch, then hold it near the reader. When shopping on a MacBook Pro featuring the Touch Bar, you can complete your purchase by simply placing your finger on Touch ID.Samsung Pay

Just hold your mobile device near the reader with your finger on Touch ID. Samsung Pay can be used almost anywhere consumers can swipe or tap their card. The more you use Samsung Pay, the more Samsung rewards you get! To enroll just open the Samsung Pay app, tap the Rewards icon, and accept the Terms and Conditions. Earn ten points for every qualifying purchase. After you earn some points, choose a reward from the Samsung catalog, which features everything from gift cards to the latest Samsung products.

Just hold your mobile device near the reader with your finger on Touch ID. Samsung Pay can be used almost anywhere consumers can swipe or tap their card. The more you use Samsung Pay, the more Samsung rewards you get! To enroll just open the Samsung Pay app, tap the Rewards icon, and accept the Terms and Conditions. Earn ten points for every qualifying purchase. After you earn some points, choose a reward from the Samsung catalog, which features everything from gift cards to the latest Samsung products. Fitbit & Garmin Pay

Fitbit Pay

Garmin Pay

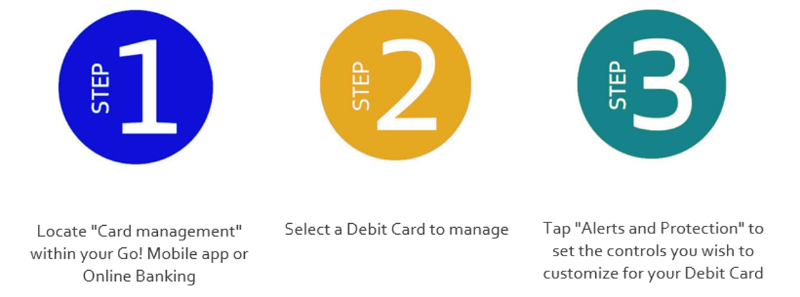

Card Management

Our powerful, portable app offers advanced Debit Card controls that allow you to safely and securely manage your money. It's as easy as 1-2-3 to set alerts and restrictions on your Debit Card(s), just follow the instructions below!

- Toggle to lock and unlock your Debit Card in real time.

- Within Alerts and Protections, manage your notification settings to be alerted via text message, e-mail, or in-app messages for blocked transaction and notification alerts.

- Protection options allow you to toggle on and be alerted for all Debit Card transactions.

- Additional customization available for Locations, Merchant Types, Transaction Types, and Spending Limits.

- Existing Debit Card limits set by Citizens Bank Minnesota remain in place. In Card Management you now have the capability to set and adjust additional transaction and monthly limits as desired to further protect your Debit Card from potential fraud. Changes made within Card Management take effect immediately.

- International settings are only applicable if you have contacted the bank for a temporary unblock of international location, for purchase or travel.